Why Digital Marketing and Lead Generation Are More Important Than Ever

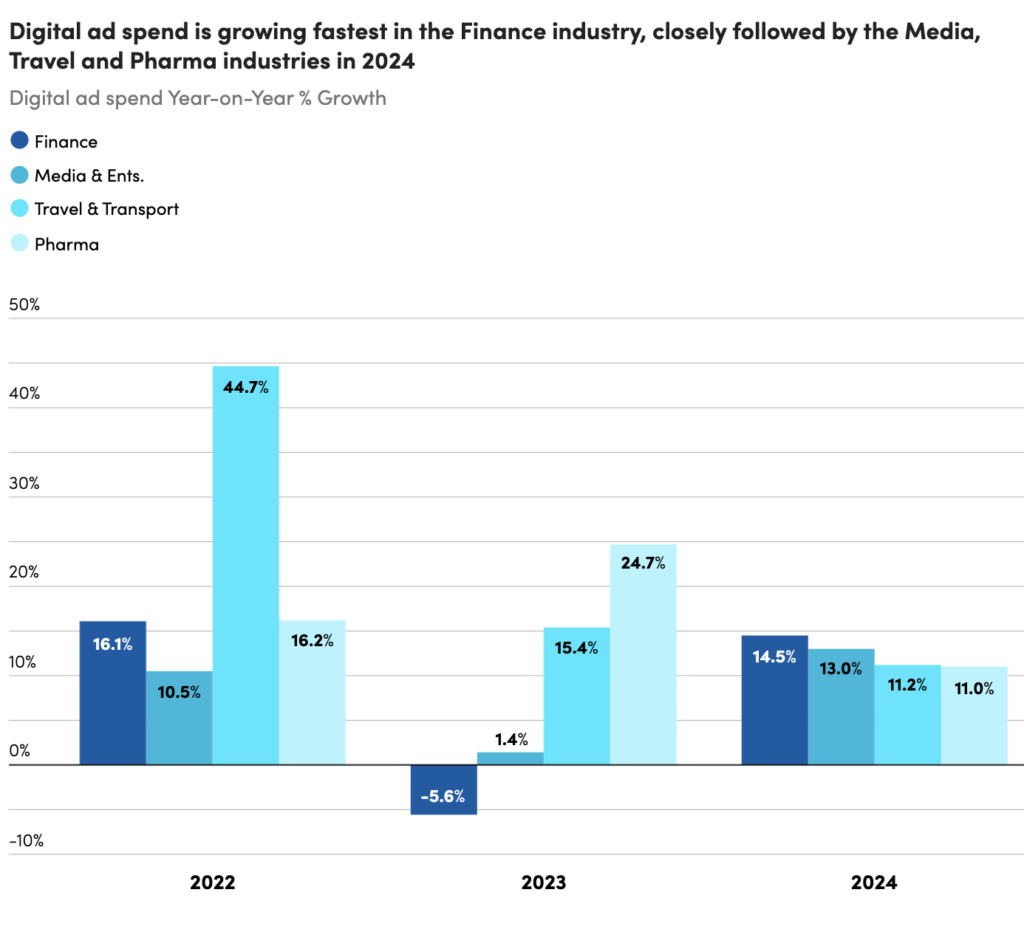

After a period of cautious investment, Financial Services Firms are ramping up their digital marketing and lead generation efforts. In 2024, the sector saw the fastest growth in digital ad spending, increasing by 14.5% year-over-year (YoY)—outpacing Media (13.0%), Travel (11.2%), and Pharma (11.0%).*

What’s Driving the Surge in Digital Ad Spend?

As competition increases, financial services firms turn to advanced B2B lead generation tools and strategies to maximize return on investment (ROI) and engage the right audience. Key factors driving this shift include:

✔ Omnichannel Lead Generation Strategies – Firms adopt multi-channel marketing approaches, ensuring a seamless customer experience across social media, search ads, email, and paid media.

✔ AI-Powered Targeting & Personalisation – The rise of automation and data-driven marketing is helping firms reach high-intent decision-makers with precision-targeted B2B lead generation campaigns.

✔ Competitive Pressure from FinTechs – Traditional financial firms must innovate their lead generation strategies to stay ahead of disruptive fintech competitors.

What Is an Omnichannel Lead Gen Strategy?

To stay competitive, financial firms need to move beyond single-channel marketing. A strong lead gen strategy leverages:

✔ LinkedIn B2B Lead Generation – The most effective platform for reaching financial decision-makers and C-suite executives.

✔ SEO & Content Marketing – A long-term strategy for attracting high-quality inbound leads through thought leadership.

✔ Email Outreach & Retargeting Ads – Keeping prospects engaged throughout the sales funnel.

✔ Paid Search & Display Ads – Ensuring your brand stays visible when potential clients search for B2B financial services.

At REVINON, we specialise in helping financial services firms implement high-impact lead generation strategies that drive real business growth.

Conclusion – What’s Next for Financial Services Lead Generation?

With B2B lead generation tools and digital ad spend increasing, expect firms to invest heavily in:

✔ AI & Automation – Smarter, data-driven targeting for higher conversion rates.

✔ Hyper-Personalisation – Delivering the right message to the right audience at the right time.

✔ Advanced Retargeting Strategies – Keeping financial decision-makers engaged throughout their buyer journey.

The shift toward data-powered, omnichannel lead generation is clear—is your firm prepared?

Hello, I’m Karel – Founder at @REVINON. At REVINON, we specialize in account-based marketing, business growth strategies, and market research. Our mission is to partner with innovative, forward-thinking financial services firms to help them unlock new growth opportunities.

📊 Source: Raconteur, June 2024: Digital dominance: brands shift ad spend online in the hunt for results